Over the past six months, Alamo’s shares (currently trading at $191.89) have posted a disappointing 11.3% loss, well below the S&P 500’s 7.7% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Alamo, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Alamo Not Exciting?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons you should be careful with ALG and a stock we'd rather own.

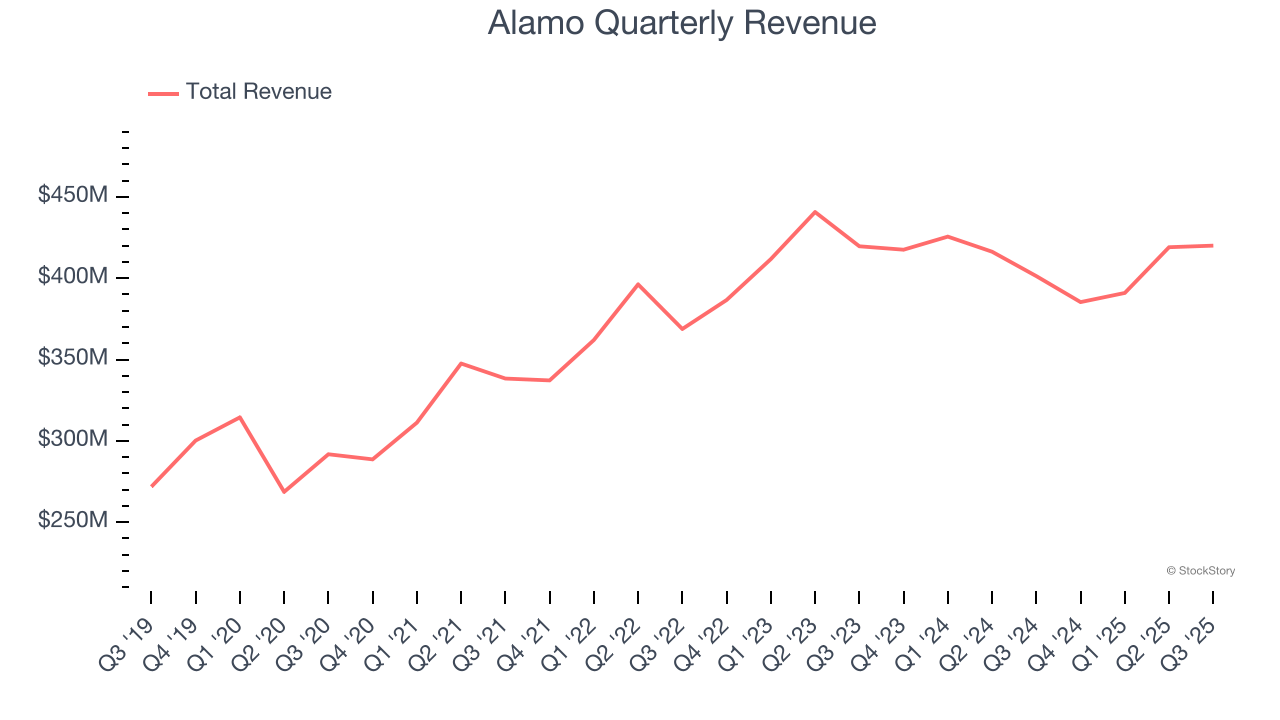

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Alamo’s 6.6% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the industrials sector.

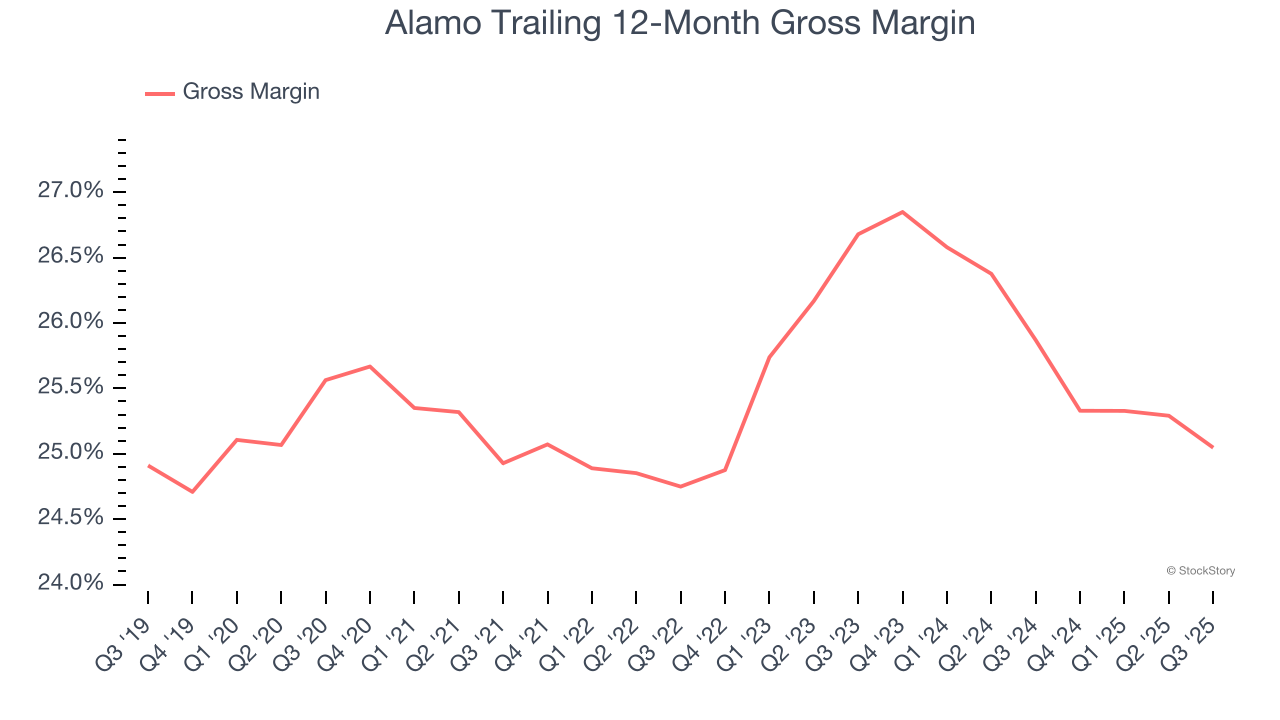

2. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Alamo has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 25.5% gross margin over the last five years. That means Alamo paid its suppliers a lot of money ($74.50 for every $100 in revenue) to run its business.

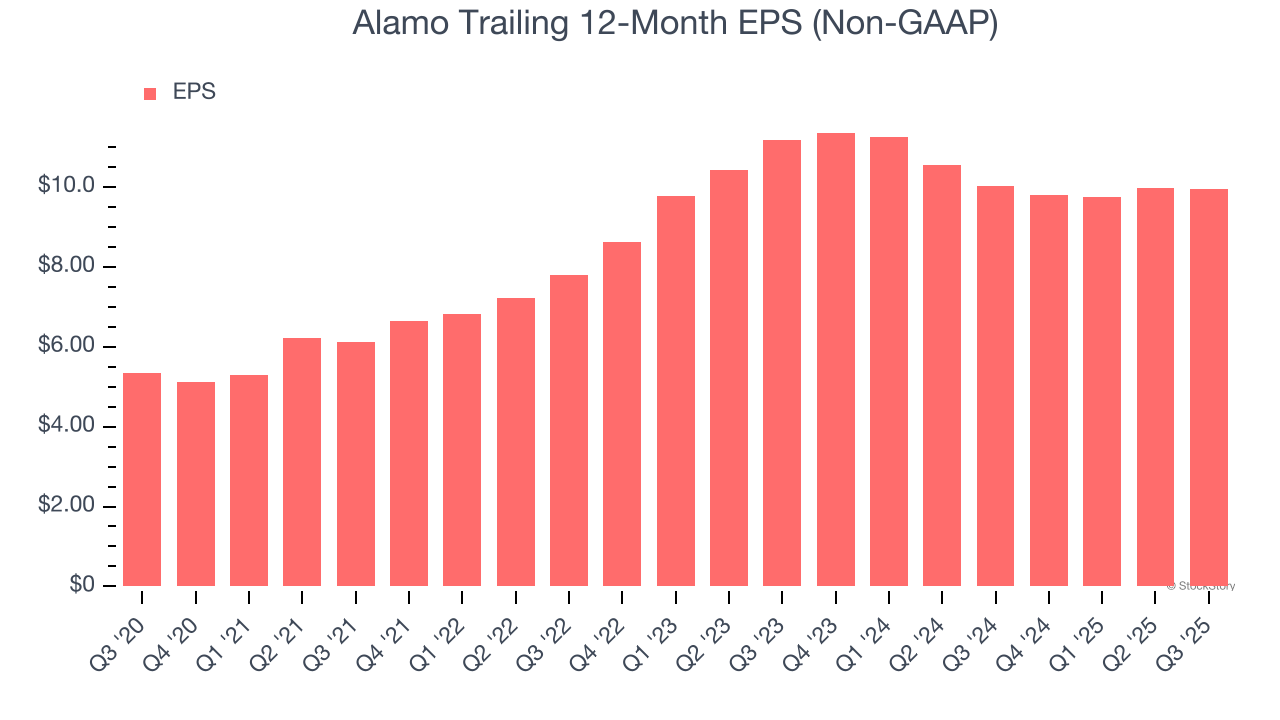

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Alamo, its EPS declined by more than its revenue over the last two years, dropping 5.7%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Alamo isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 16.8× forward P/E (or $191.89 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Alamo

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.