Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

As of February 6, 2026, the United States labor market appears to have entered a new phase of equilibrium, characterized by the Federal Reserve as a "low-hire, low-fire" environment. Despite a partial government shutdown that has indefinitely delayed the release of the official January Employment Situation report, private sector data

Via MarketMinute · February 6, 2026

As the first quarter of 2026 unfolds, the financial markets are navigating a paradoxical landscape defined by aggressive fiscal expansion and unprecedented geopolitical friction. While the "Stampeding Bull" of 2024 and 2025 was driven by a frenzy of price-to-earnings expansion and artificial intelligence (AI) hype, a new narrative has taken

Via MarketMinute · February 6, 2026

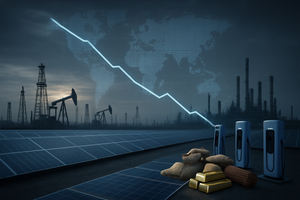

As of February 6, 2026, the North American energy landscape has reached a historic inflection point. The frantic merger and acquisition (M&A) wave that gripped the industry between 2023 and 2025 has largely transitioned into an intensive integration phase, fundamentally reshaping the sector into a more concentrated market dominated

Via MarketMinute · February 6, 2026

As of February 6, 2026, the technology sector is witnessing a paradoxical shift in the mergers and acquisitions (M&A) landscape. While the sheer number of transactions has hit an eight-year plateau, the total capital being deployed is reaching historic highs. This "K-shaped" recovery in deal-making is almost entirely driven

Via MarketMinute · February 6, 2026

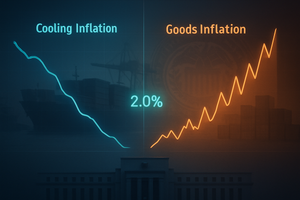

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

As of February 6, 2026, the American consumer landscape has fractured into two distinct realities, creating a "K-shaped" economic environment that is redefining the retail and service sectors. While a record-breaking stock market and robust asset growth have propelled affluent households to new heights of discretionary spending, lower-income Americans are

Via MarketMinute · February 6, 2026

The global energy landscape has undergone a seismic shift, culminating in a staggering 98% year-over-year surge in deal value for the Power and Utilities (P&U) sector as of early 2026. According to the latest market data from January 2026, the sector has transitioned from a traditional defensive haven into

Via MarketMinute · February 6, 2026

As of February 6, 2026, the global financial landscape is being reshaped by an unprecedented "wall of capital." After nearly two years of stagnation caused by valuation gaps and high borrowing costs, the private equity industry has entered a transformative period of deployment. With a record-shattering $3.2 trillion in

Via MarketMinute · February 6, 2026

As of February 6, 2026, the global financial landscape is characterized by a high-stakes tug-of-war between record-breaking corporate earnings and extreme market concentration. Major Wall Street institutions, led by JPMorgan Chase & Co. (NYSE: JPM), have released a series of aggressive 2026 outlooks that forecast a robust 13% to 15% earnings

Via MarketMinute · February 6, 2026

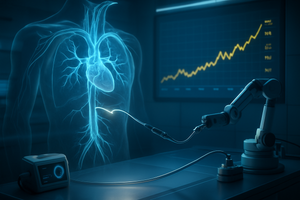

The life sciences sector has entered 2026 in the midst of a historic transformation, as deal volume and value surged by a staggering 82% over the past year. This "Great Rebound," fueled by a record-shattering $240 billion in total M&A investment in 2025, represents a fundamental shift in how

Via MarketMinute · February 6, 2026

SAN FRANCISCO – As of February 6, 2026, the global financial landscape has shifted into a new, higher gear, defined by what analysts are calling the "AI Capital Expenditure Supercycle." A series of blockbuster reports from leading financial institutions and technology giants has confirmed a staggering reality: global spending on data

Via MarketMinute · February 6, 2026

As of February 6, 2026, the media and entertainment landscape is undergoing a tectonic shift not seen in nearly a decade. The industry has been rocked by the formal announcement and subsequent regulatory scrutiny of Netflix (NASDAQ:NFLX)'s staggering $82.7 billion acquisition of the core film and television

Via MarketMinute · February 6, 2026

As of February 6, 2026, the global financial landscape is still reverberating from a historic tectonic shift that occurred in the final months of last year. In the fourth quarter of 2025, the M&A market witnessed an unprecedented "mega-deal" frenzy, with 22 global transactions valued at over $10 billion

Via MarketMinute · February 6, 2026

The long-awaited "deal drought" has officially broken. As of early February 2026, the American financial landscape is being reshaped by a massive resurgence in corporate deal-making, punctuated by a staggering 111.5% year-over-year increase in transactions valued over $100 million at the close of 2025. This tidal wave of capital

Via MarketMinute · February 6, 2026

The latest Personal Consumption Expenditures (PCE) price index data has revealed a significant shift in the U.S. inflationary landscape, presenting a complex puzzle for the Federal Reserve. As of early February 2026, the data shows a stark divergence: while the services sector—the primary engine of post-pandemic inflation—is

Via MarketMinute · February 6, 2026

The specter of a prolonged federal freeze dissipated early this week as President Donald Trump signed a $1.2 trillion spending package into law on February 3, 2026. The move officially ended a four-day partial government shutdown that had paralyzed several federal agencies since the clock struck midnight on January

Via MarketMinute · February 6, 2026

As the final reports from the 2025 year-end earnings season filter through Wall Street, the "Magnificent 7" have once again demonstrated their dominance, but with a critical new caveat. The early February 2026 results reveal a group of companies that are no longer just building the "digital railroads" of Artificial

Via MarketMinute · February 6, 2026

The global financial landscape has been sent into a whirlwind of speculation and strategic repricing following President Trump’s formal nomination of Kevin Warsh to succeed Jerome Powell as the next Chair of the Federal Reserve. Announced on January 30, 2026, the move marks a pivotal transition for the world’

Via MarketMinute · February 6, 2026

Agricultural markets are entering a period of profound uncertainty as a confluence of surging input costs, volatile weather patterns, and shifting geopolitical alliances threaten to destabilize global food security. Despite a period of relative stabilization throughout 2025, early data from February 2026 suggests the "calm" is rapidly evaporating. According to

Via MarketMinute · February 6, 2026

The Federal Reserve Open Market Committee (FOMC) concluded its first policy meeting of 2026 on January 28, voting to maintain the federal funds rate at a target range of 3.5% to 3.75%. This widely anticipated decision marks a pivotal shift in the central bank’s strategy, moving from

Via MarketMinute · February 6, 2026

The Great Commodity Divergence: Broad Funds Rally While Precious Metals Face 'Breathtaking' Volatility

As investors navigate the opening weeks of 2026, the commodity markets have transformed into a tale of two realities. While broad-based commodity vehicles like the WisdomTree Commodity Index Fund (NYSE Arca: GCC) have surged a remarkable 10.

Via MarketMinute · February 6, 2026

The fourth-quarter earnings season of 2025 has reached a fever pitch, delivering a resounding message of resilience to Wall Street. As of February 6, 2026, the S&P 500 has reported an aggregate year-over-year earnings growth of 10.1%, a figure that has silenced skeptics who feared a late-cycle slowdown.

Via MarketMinute · February 6, 2026

The global economic landscape is facing a profound shift as the World Bank’s latest "Commodity Markets Outlook," released in early February 2026, forecasts that commodity prices will plummet to their lowest levels in six years. This decline marks the fourth consecutive year of retreating prices, signaling the definitive end

Via MarketMinute · February 6, 2026

The U.S. energy market was rocked in January 2026 as natural gas prices skyrocketed by a staggering 78.4%, catapulting from a December average of $4.25 per million BTU to a peak average of $7.58. This historic surge, detailed in the latest World Bank Commodity Markets report,

Via MarketMinute · February 6, 2026

As of February 6, 2026, the agricultural sector finds itself at the center of a high-stakes tug-of-war between digital diplomacy and physical market fundamentals. This week, the soybean market transformed into a volatile arena where a single social media post from President Donald Trump managed to erase weeks of bearish

Via MarketMinute · February 6, 2026

The global energy market has been jarred by a "violent reversal" in crude oil prices during the first week of February 2026. After a blistering 14% rally in January that saw West Texas Intermediate (WTI) surge to multi-month highs near $67 per barrel, the benchmark has slid approximately 6% in

Via MarketMinute · February 6, 2026

As the global energy sector faces a softening crude market in early 2026, BP (LSE: BP) has emerged as an unexpected outlier. Despite a broader slump in oil prices—with Brent crude hovering in the mid-$60s amid a global supply surplus—shares of the London-based major have climbed 4.

Via MarketMinute · February 6, 2026

LONDON — Shell, the British energy giant, reported its weakest quarterly profit in nearly five years on February 5, 2026, as a combination of cooling global oil prices and a protracted downturn in the chemicals market finally caught up with the company’s bottom line. The London-based major posted adjusted earnings

Via MarketMinute · February 6, 2026

In an extraordinary display of market volatility that has blindsided global economists, the silver market has just concluded a historic monthly rally, posting a staggering gain of approximately 65%. This meteoric rise, which saw the metal breach the triple-digit barrier to hit an intraday high of $121.67 per ounce,

Via MarketMinute · February 6, 2026

The global financial landscape underwent a seismic shift in the first week of February 2026, as the nomination of Kevin Warsh to succeed Jerome Powell as Chairman of the Federal Reserve sent shockwaves through the commodities and currency markets. The announcement, made by the White House on January 30 and

Via MarketMinute · February 6, 2026

The commodities super-cycle of the mid-2020s hit a violent, brick wall this week in what traders are already calling the "Warsh Meltdown." After a multi-year rally that saw gold reach stratospheric heights, the market experienced a historic systemic liquidity rupture. Gold prices, which peaked at a staggering $5,594 per

Via MarketMinute · February 6, 2026

As of February 6, 2026, the global financial landscape is grappling with a profound paradigm shift: the erosion of trust in the "full faith and credit" of the U.S. government. In the opening weeks of 2026, gold and silver have transitioned from traditional hedges to primary stores of value,

Via MarketMinute · February 6, 2026

As of February 6, 2026, the financial world is witnessing a tectonic shift in capital allocation as investors desert traditional equities and bonds in favor of the millennia-old security of precious metals. This "stampede" into exchange-traded funds (ETFs) has reached a fever pitch, with the SPDR Gold Trust (NYSE Arca:

Via MarketMinute · February 6, 2026

The precious metals market has entered a period of unprecedented turbulence, leaving investors to navigate a complex landscape where record-breaking bullion prices do not always translate to stable equity gains. In early 2026, the mining sector has become the epicenter of a "mechanical failure" in the markets, as gold and

Via MarketMinute · February 6, 2026

In a move that has rewritten the financial history books, gold prices have surged past the $4,700 per ounce milestone, while silver continues its meteoric ascent toward the elusive $110 mark. This unprecedented rally, peaking in early February 2026, marks a seismic shift in the global financial landscape as

Via MarketMinute · February 6, 2026

In a move that has sent shockwaves through the medical technology sector, Boston Scientific (NYSE:BSX) announced on January 15, 2026, a definitive agreement to acquire Penumbra (NYSE:PEN) for approximately $14.5 billion. The deal represents the largest acquisition for Boston Scientific in over two decades, signaling a transformative

Via MarketMinute · February 5, 2026

The U.S. economy has officially entered a new phase of high-octane efficiency, according to the latest data released by the Bureau of Labor Statistics. In a report that has sent ripples through the global financial markets this February 5, 2026, nonfarm productivity was revealed to have surged at a

Via MarketMinute · February 5, 2026

The meteoric rise of Carvana Co. (NYSE: CVNA), the online used car retailer that became a symbol of post-pandemic recovery, hit a massive wall of skepticism this week. In a dramatic reversal of fortune, Carvana’s shares plummeted more than 14% following a scathing report from activist short seller Gotham

Via MarketMinute · February 5, 2026

Nearly one year ago, the observability and IT management software sector was rocked by the news that SolarWinds Corporation (formerly NYSE: SWI) would be taken private by Turn/River Capital in a deal valued at approximately $4.4 billion. Today, as of February 5, 2026, the ripple effects of that

Via MarketMinute · February 5, 2026

In a move that has fundamentally reshaped the landscape of American infrastructure, Blackstone Infrastructure Partners has finalized its blockbuster $5.65 billion acquisition of Safe Harbor Marinas. The deal, which saw the world’s largest marina operator transition from the portfolio of Sun Communities, Inc. (NYSE:SUI) to the private

Via MarketMinute · February 5, 2026

The narrative of the artificial intelligence revolution shifted dramatically this week from the processing power of chips to the massive capacity required to store the data they generate. Seagate Technology Holdings plc (NASDAQ: STX) saw its stock price surge by a staggering 19% following a fiscal second-quarter earnings report that

Via MarketMinute · February 5, 2026

In a historic session that has sent shockwaves through global financial centers, the gold market suffered its most precipitous one-day decline in decades on Friday, January 30, 2026. After a nearly vertical climb throughout 2025 that saw bullion prices touch all-time highs near $5,600 an ounce, the "yellow metal"

Via MarketMinute · February 5, 2026

The U.S. labor market continues to defy expectations of a sharp downturn, as the latest employment data reveals a resilient economy that refuses to buckle under the weight of sustained interest rates. The Bureau of Labor Statistics reported this morning that the U.S. economy added 175,000 nonfarm

Via MarketMinute · February 5, 2026

As of early February 2026, the long-standing dominance of high-growth technology and artificial intelligence (AI) stocks has hit a significant wall, triggering a massive "Great Rebalancing" across the U.S. financial markets. Investors, once captivated by the promise of infinite AI scaling, are now rotating aggressively into defensive and value-oriented

Via MarketMinute · February 5, 2026

The S&P 500 has reached a pivotal juncture in early 2026, pushing toward the historic 6,144-point milestone, a level that has become a lightning rod for technical analysts and institutional strategists alike. This push to record highs comes at a paradoxical moment for Wall Street; while the headline

Via MarketMinute · February 5, 2026

The global economic landscape has been jolted in the opening weeks of 2026 as the United States government formalizes a series of aggressive 25% tariff proposals targeting the critical sectors of semiconductors, automobiles, and pharmaceuticals. These measures, framed as essential for national security and domestic industrial revitalization, have sent shockwaves

Via MarketMinute · February 5, 2026

In a sharp reversal of the optimistic momentum seen at the end of last year, U.S. consumer confidence has tumbled to an eight-month low, with the Conference Board’s Consumer Confidence Index falling to 98.3 in January 2026. This decline marks a significant psychological shift among American households,

Via MarketMinute · February 5, 2026

The financial world is currently navigating the "Warsh Shock," a period of intense market recalibration following President Donald Trump’s nomination of Kevin Warsh as the next Chairman of the Federal Reserve on January 30, 2026. As the successor to Jerome Powell, Warsh represents a dramatic shift in monetary philosophy,

Via MarketMinute · February 5, 2026

In a dramatic week for the pharmaceutical sector, a stark rift has opened between the two undisputed titans of the weight-loss drug market. On February 4, 2026, Eli Lilly (NYSE:LLY) reported a staggering 45% surge in full-year 2025 revenue, propelled by the insatiable global demand for its blockbuster treatments,

Via MarketMinute · February 5, 2026

SANTA CLARA, CA — As of February 5, 2026, the landscape of the artificial intelligence data center market has been fundamentally redrawn. Advanced Micro Devices (NASDAQ: AMD) has successfully completed its integration of ZT Systems, a $4.9 billion acquisition that marked the company's most aggressive move to date to dismantle

Via MarketMinute · February 5, 2026

One year after officially closing its $6.4 billion acquisition of HashiCorp, International Business Machines Corp. (NYSE:IBM) has successfully transformed its software portfolio, positioning itself as the central nervous system for modern multi-cloud environments. By merging HashiCorp’s ubiquitous infrastructure-as-code and security tools with the industrial-grade power of Red

Via MarketMinute · February 5, 2026

Tesla, Inc. (NASDAQ: TSLA) has officially signaled the end of its era as a mere high-volume electric vehicle manufacturer, reporting Q4 2025 earnings that exceeded analyst expectations while simultaneously doubling down on Elon Musk’s artificial intelligence ambitions. The company confirmed a strategic $2 billion investment into xAI, the artificial

Via MarketMinute · February 5, 2026

The honeymoon phase of the artificial intelligence revolution has officially ended, replaced by a cold, hard era of fiscal scrutiny. In its latest quarterly earnings report on January 28, 2026, Microsoft (NASDAQ:MSFT) stunned the market not with a lack of ambition, but with a record-shattering $37.5 billion in

Via MarketMinute · February 5, 2026

Meta Platforms (NASDAQ: META) has fundamentally rewritten the playbook for Big Tech growth, pivoting from its celebrated "Year of Efficiency" into a massive "Scaling Phase" defined by unprecedented capital expenditure. Following a blockbuster Q4 2025 earnings report that saw revenue climb 24% to $59.9 billion, the company stunned Wall

Via MarketMinute · February 5, 2026

SANTA CLARA, Calif. — In a financial performance that has become the definitive pulse-check for the global technology sector, Nvidia (NASDAQ: NVDA) recently delivered a record-shattering earnings report that effectively silenced skeptics of the artificial intelligence (AI) revolution—at least for now. The semiconductor giant posted a staggering $39.3 billion

Via MarketMinute · February 5, 2026

As the calendar turns to early February 2026, the global financial community is fixated on 1 First Street NE, Washington, D.C. The Supreme Court of the United States is expected to issue a final ruling in Learning Resources, Inc. v. Trump, a consolidated case that challenges the legality of

Via MarketMinute · February 5, 2026

The U.S. stock market is currently witnessing a tectonic shift in capital allocation as the "AI hype cycle" of the early 2020s gives way to the "Physical Reality" of 2026. In the first five weeks of the year, a massive sector rotation has seen billions of dollars exit high-multiple

Via MarketMinute · February 5, 2026

SAN FRANCISCO – Shares of Uber Technologies, Inc. (NYSE: UBER) fell 5.2% in early trading on February 5, 2026, following the release of its fourth-quarter 2025 financial results. Despite reaching record trip volumes and reporting a nominal beat on top-line revenue, the ride-hailing giant failed to convince investors that its

Via MarketMinute · February 5, 2026

The "Great Hesitation" in global finance has officially come to an end. In the opening weeks of 2026, the private equity landscape has undergone a dramatic transformation, shifting from two years of defensive posturing to a full-scale dealmaking renaissance. Driven by a record-shattering $2 trillion in "dry powder" and a

Via MarketMinute · February 5, 2026

In a move that signals the complete integration of digital assets into the global financial architecture, CME Group (NASDAQ: CME) has announced the expansion of its cryptocurrency derivatives suite to include Cardano (ADA), Chainlink (LINK), and Polkadot (DOT). The launch, set to take place on February 9, 2026, is paired

Via MarketMinute · February 5, 2026

In a move that has sent ripples through the commercial real estate (CRE) sector, global investment giant Brookfield Asset Management (NYSE: BAM)—and its parent Brookfield Corporation (NYSE: BN)—announced a definitive agreement to acquire Peakstone Realty Trust (NYSE: PKST) for approximately $1.2 billion. The deal, priced at $21.

Via MarketMinute · February 5, 2026

In a market currently defined by the "Great Recalibration"—where investors have traded blind optimism for a ruthless demand for profitability—Palantir Technologies Inc. (NYSE: PLTR) has emerged as the undisputed titan of the enterprise AI landscape. On February 2, 2026, the Denver-based software giant released a fourth-quarter 2025 earnings

Via MarketMinute · February 5, 2026

As the financial world turns its gaze toward Seattle, Amazon.com Inc. (NASDAQ:AMZN) is prepared to pull back the curtain on its fourth-quarter 2025 financial results this afternoon, February 5, 2026. The report comes at a pivotal moment for the tech giant, which has spent the last year navigating

Via MarketMinute · February 5, 2026

As of February 5, 2026, the financial world has its eyes fixed on a single number: $180. NVIDIA Corporation (NASDAQ:NVDA), the undisputed heavyweight champion of the artificial intelligence era, is currently testing this critical psychological and technical support level. After a period of "coiling" price action that defined the

Via MarketMinute · February 5, 2026

NEW YORK — The global financial landscape has been fundamentally altered in the span of 36 hours as a historic "flash crash" in the precious metals sector wiped out nearly $7 trillion in market value. Gold and silver, which had enjoyed a multi-year bull run fueled by geopolitical tensions and inflationary

Via MarketMinute · February 5, 2026

Microsoft Corp. ((NASDAQ: MSFT)) saw its market valuation suffer a historic blow following its latest earnings report for the period ending December 31, 2025 (Calendar Q4), as investors pivoted from rewarding artificial intelligence (AI) potential to demanding immediate, tangible returns. Despite reporting headline revenue and earnings that exceeded analyst consensus,

Via MarketMinute · February 5, 2026

In a move signaling the stock market’s continued embrace of the artificial intelligence infrastructure trade, S&P Dow Jones Indices announced late Wednesday that Ciena Corporation (NYSE: CIEN) will join the S&P 500 benchmark. The inclusion, effective before the opening of trading on Monday, February 9, 2026, marks

Via MarketMinute · February 5, 2026

In a move that has sent shockwaves through global commodities markets, rare earth and critical materials stocks suffered a sharp sell-off this week following the U.S. administration's announcement of a "tariff floor" policy. The new regulatory framework, unveiled by Vice President J.D. Vance during a Critical Minerals Ministerial

Via MarketMinute · February 5, 2026

As the first week of February 2026 unfolds, a dramatic shift in investor sentiment has split the U.S. stock market. While technology and artificial intelligence stocks have faced a sharp pullback, the healthcare sector has emerged as the market's primary engine of growth. The Dow Jones Industrial Average surged

Via MarketMinute · February 5, 2026

The high-octane momentum of the artificial intelligence sector hit a significant wall on February 4, 2026, as Advanced Micro Devices (NASDAQ:AMD) saw its stock price plummet by 17.3%. The sell-off, which erased more than $560 billion in market capitalization in a single trading session, came despite the company

Via MarketMinute · February 5, 2026

Despite delivering a resounding earnings beat for the final quarter of 2025, Alphabet Inc. (NASDAQ: GOOGL) has sent shockwaves through the financial markets by signaling an unprecedented capital expenditure plan for 2026. The tech giant announced on February 4, 2026, that it intends to spend between $175 billion and $185

Via MarketMinute · February 5, 2026

In a move that has fundamentally reshaped the outlook for global monetary policy, President Donald Trump officially nominated Kevin Warsh on January 30, 2026, to succeed Jerome Powell as the 17th Chair of the Federal Reserve. The announcement has sent immediate shockwaves through the financial system, ending months of speculation

Via MarketMinute · February 5, 2026

The era of easy-money optimism faced a stark reality check this week as the benchmark U.S. 10-year Treasury yield surged past the critical 4.20% technical resistance level, reaching heights not seen since the volatility of late 2024. This breakout, which saw yields climb as high as 4.29%

Via MarketMinute · February 5, 2026

As the final results of the Q4 2025 earnings season trickle in this February 5, 2026, the Wall Street narrative remains dominated by a familiar story: a two-speed economy. The "Magnificent Seven" tech giants continue to power the broader market higher, while the rest of the S&P 500 struggles

Via MarketMinute · February 5, 2026

The second phase of the Q4 earnings season officially moves into high gear this Tuesday, February 10, 2026, as a critical cohort of financial institutions and market infrastructure giants prepare to release their results. While the initial wave of money-center banks in January provided a glimpse into corporate health, this

Via MarketMinute · February 5, 2026