Robinhood Markets, Inc. - Class A Common Stock (HOOD)

81.49

+8.81 (12.12%)

NASDAQ · Last Trade: Feb 6th, 11:09 AM EST

Detailed Quote

| Previous Close | 72.68 |

|---|---|

| Open | 77.86 |

| Bid | 81.46 |

| Ask | 81.49 |

| Day's Range | 77.12 - 82.30 |

| 52 Week Range | 29.66 - 153.86 |

| Volume | 25,040,465 |

| Market Cap | 18.96B |

| PE Ratio (TTM) | 33.81 |

| EPS (TTM) | 2.4 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 26,875,597 |

Chart

About Robinhood Markets, Inc. - Class A Common Stock (HOOD)

Robinhood Markets Inc is a financial technology company that provides a digital platform for trading stocks, options, and cryptocurrencies. Designed to make investing accessible to a broader audience, Robinhood offers commission-free trades and has gained popularity for its user-friendly mobile app, which allows users to buy and sell financial instruments with ease. In addition to its trading services, the company also offers features such as cash management, educational resources, and research tools, aiming to empower investors of all experience levels to take control of their financial futures. Read More

News & Press Releases

Investors should be prepared for a different type of bull market.

Via The Motley Fool · February 6, 2026

Robinhood Markets Inc (NASDAQ: HOOD) shares are surging Friday morning, driven by volatility in the broader crypto market.

Via Benzinga · February 6, 2026

These S&P500 stocks that are showing activity before the opening bell on Friday.chartmill.com

Via Chartmill · February 6, 2026

High dividend yields can be great but often warrant thorough analysis before investing.

Via The Motley Fool · February 6, 2026

Robinhood Stock Is Falling Today Despite Retail Calling It ‘Oversold’ – What’s Driving Such A Selloff?stocktwits.com

Via Stocktwits · February 4, 2026

A trio of low-cost exchange-traded funds (ETFs) account for three of the 10 most-held securities by Robinhood's retail investors.

Via The Motley Fool · February 6, 2026

Buying and holding long-term stocks can help you outperform traders in less time.

Via The Motley Fool · February 5, 2026

The financial world is currently navigating the "Warsh Shock," a period of intense market recalibration following President Donald Trump’s nomination of Kevin Warsh as the next Chairman of the Federal Reserve on January 30, 2026. As the successor to Jerome Powell, Warsh represents a dramatic shift in monetary philosophy,

Via MarketMinute · February 5, 2026

Prediction markets are interesting developments, but are they the long-term opportunity that investors are hoping for?

Via The Motley Fool · February 5, 2026

Curious about which S&P500 stocks are generating unusual volume on Thursday? Find out below.chartmill.com

Via Chartmill · February 5, 2026

In the world of finance, information has always been the most valuable currency. But as of early 2026, how that information is gathered, verified, and broadcast has undergone a fundamental transformation. The 2024 U.S. Election was the "proof-of-concept" for prediction markets; today, they have become the "Oracle Layer" for the global economy. Major media conglomerates, [...]

Via PredictStreet · February 5, 2026

The capture of Venezuelan leader Nicolás Maduro by U.S. special operations forces on January 3, 2026, was a geopolitical earthquake that few saw coming. But for one anonymous trader on the decentralized prediction platform Polymarket, the event was more than a headline—it was a $400,000 windfall. Hours before President Donald Trump took to Truth Social, [...]

Via PredictStreet · February 5, 2026

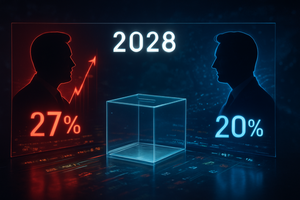

While the dust of the 2024 election cycle has barely settled, the financial world is already placing its bets on the next battle for the White House. As of February 2026, prediction markets—the once-niche platforms that successfully forecasted the 2024 outcome with surgical precision—are signaling a clear trajectory for the 2028 U.S. Presidential Election. Vice [...]

Via PredictStreet · February 5, 2026

As the clock ticks toward the February Consumer Price Index (CPI) release, a new kind of "game day" ritual is taking over the morning routines of young investors. Forget the NFL playoffs or the NBA finals—for the 24 million active users on Robinhood (NASDAQ: HOOD), the most exciting play of the season is the "Macro [...]

Via PredictStreet · February 5, 2026

The global financial landscape has shifted into a new era of "Information Finance," or InfoFi, where the most valuable commodity is not gold or oil, but the "truth." As of February 5, 2026, the battle for dominance in this sector has narrowed down to two titans: Polymarket, the decentralized, crypto-native pioneer, and Kalshi, the regulated, [...]

Via PredictStreet · February 5, 2026

The prediction market industry has officially shed its label as a niche corner of the internet for political junkies and sports bettors. As of early February 2026, the sector is celebrating a watershed moment: total trading volume surpassed a staggering $45 billion in 2025, a nearly five-fold increase from the previous year. This momentum shows [...]

Via PredictStreet · February 5, 2026

Robinhood Markets Inc (NASDAQ:HOOD) shares are trading lower as Bitcoin

Via Benzinga · February 5, 2026

These S&P500 stocks that are showing activity before the opening bell on Thursday.chartmill.com

Via Chartmill · February 5, 2026

Other than both companies being in the cryptocurrency space, the shares of Circle and Bullish were trading below their IPO levels.

Via Stocktwits · February 5, 2026

Nasdaq, S&P 500 Futures Subdued Ahead Of Amazon Earnings: Why GOOGL, AVGO, MSFT, HOOD Are On Traders' Radar Todaystocktwits.com

Via Stocktwits · February 5, 2026

An analyst noted that February has historically been a difficult month for equities.

Via Stocktwits · February 5, 2026

If selected to supervise the "Trump Accounts," Robinhood could see a nice inflow of assets under management.

Via The Motley Fool · February 4, 2026

Shares of financial services company Robinhood (NASDAQ:HOOD)

fell 8.4% in the afternoon session after software stocks continued to pull back as investors assessed the potential for new AI automation tools to compete with established software platforms.

Via StockStory · February 4, 2026

Explore the top gainers and losers within the S&P500 index in today's session.chartmill.com

Via Chartmill · February 4, 2026

Both had strong momentum last year.

Via The Motley Fool · February 4, 2026