Archer Aviation Inc. Class A Common Stock (ACHR)

6.7600

+0.00 (0.00%)

NYSE · Last Trade: Feb 13th, 8:04 AM EST

This next-gen aircraft maker has plenty of irons in the fire.

Via The Motley Fool · February 12, 2026

ACHR Stock Snaps 2-Day Rally After Short-Seller Raises 3 Questions For CEOstocktwits.com

Via Stocktwits · February 11, 2026

Archer Aviation is down roughly 20% on the year.

Via The Motley Fool · February 10, 2026

Archer Aviation has big plans for 2026. Could this be your last chance to buy while it's below $10?

Via The Motley Fool · February 9, 2026

ACHR has seen a rise in investor optimism as Cathie Wood’s stake and more partnerships with countries such as Serbia deepen its role in the air taxi space.

Via Stocktwits · February 8, 2026

Dow Futures Push Higher After Breaking 50,000: Why OPGN, ACHR, LI, HIMS, CING Are Trending Todaystocktwits.com

Via Stocktwits · February 8, 2026

JOBY Plunges Nearly 11% After The Bell: What's Dragging The Stock?stocktwits.com

Via Stocktwits · January 28, 2026

With a huge sell-off today, XRP is now down more than 50% over the last year.

Via The Motley Fool · February 5, 2026

Recent filings from BlackRock show the money manager owns more than 8% of eVTOL maker Archer Aviation.

Via The Motley Fool · February 5, 2026

You can find big stocks with small prices.

Via The Motley Fool · February 2, 2026

Archer's share price has soared over the past three years, but there are some significant red flags with this stock.

Via The Motley Fool · February 1, 2026

Wisk, backed by Boeing, is pursuing autonomous eVTOLs, posing a threat to Joby and Archer.

Via The Motley Fool · January 31, 2026

MarketBeat Week in Review – 01/26 - 01/30marketbeat.com

Via MarketBeat · January 31, 2026

The electric vertical takeoff and landing (eVTOL) market offers huge upside potential, but also downside risk.

Via The Motley Fool · January 31, 2026

This stock has bounced around for several years and is down significantly since going public nearly five years ago.

Via The Motley Fool · January 29, 2026

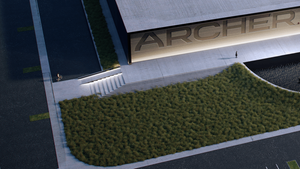

Archer Aviation develops electric aircraft for urban air mobility, targeting city commuters and commercial partners with eVTOL technology.

Via The Motley Fool · January 28, 2026

Down 39% from the peak it reached last year, what comes next for Archer Aviation?

Via The Motley Fool · January 27, 2026

Archer's future depends on one regulatory decision, and investors who understand the timing risk may gain an edge.

Via The Motley Fool · January 27, 2026

Archer Aviation develops electric aircraft for urban air mobility, targeting city commuters and commercial partners with eVTOL technology.

Via The Motley Fool · January 26, 2026

Via MarketBeat · January 26, 2026

It's not too late to get in early on this top contender in a fast-growing sector.

Via The Motley Fool · January 23, 2026

The sector looks overvalued, and retail investors have pumped prices higher.

Via The Motley Fool · January 23, 2026

BELGRADE, Serbia — Archer Aviation (NYSE: ACHR) has officially solidified its position as the undisputed frontrunner in the global race for electric vertical takeoff and landing (eVTOL) supremacy. In a high-profile signing ceremony at the 2026 World Economic Forum in Davos, Archer and the Government of the Republic of Serbia announced

Via MarketMinute · January 21, 2026

The biggest news was the U.S. government potentially spending $1.5 trillion on defense. Of course, there are strings attached, which investors don't like, but this could be an opportunity long-term.

Via The Motley Fool · January 21, 2026

Is it finally time to bet on flying electric taxis?

Via The Motley Fool · January 20, 2026