American Express (AXP)

354.01

-9.19 (-2.53%)

NYSE · Last Trade: Feb 12th, 2:51 AM EST

The financial services landscape of February 2026 has been defined by a ruthless "survival of the smartest," as the era of the fintech unicorn has officially given way to the era of the vertically integrated mega-bank. Driven by a persistent valuation reset and the desperate need for advanced artificial intelligence

Via MarketMinute · February 11, 2026

In a move that definitively reshapes the American financial landscape, Capital One Financial Corp (NYSE: COF) has announced the acquisition of fintech unicorn Brex for $5.15 billion. The deal, finalized on January 22, 2026, marks the second massive tectonic shift for the McLean-based bank in less than a year,

Via MarketMinute · February 11, 2026

Could Buying American Express (AXP) Today Set You Up for Life?fool.com

Via The Motley Fool · February 4, 2026

The American economy finds itself balanced on a precarious ledge as of early 2026. New data from the Federal Reserve Bank of New York reveals that total U.S. household debt has surged to a staggering $18.8 trillion, a record high that reflects the growing reliance of American families

Via MarketMinute · February 11, 2026

If you're looking for good long-term stocks, the Berkshire Hathaway portfolio holdings are generally a good place to start.

Via The Motley Fool · February 11, 2026

A cash-heavy balance sheet is often a sign of strength, but not always.

Some companies avoid debt because they have weak business models, limited expansion opportunities, or inconsistent cash flow.

Via StockStory · February 10, 2026

Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Mastercard (NYSE:MA) and its peers.

Via StockStory · February 10, 2026

Evercore ISI Group analyst John Pancari maintained an In-Line rating on American Express (NYSE: AXP).Pancari lowered his price target to $393 from $400.

Via Benzinga · February 10, 2026

It has been interesting to see the rise and rapid fall of certain businesses in recent years.

Via The Motley Fool · February 9, 2026

A lot of attention is being directed to the exciting things happening in the world of commerce.

Via The Motley Fool · February 9, 2026

American Express is investing in the future.

Via The Motley Fool · February 9, 2026

It can be important for investors to have a solid foundation in their portfolios.

Via The Motley Fool · February 8, 2026

American Express stock has tripled in five years. A recent premium card relaunch suggests the good times aren't over yet.

Via The Motley Fool · February 7, 2026

These stocks pay dividends, have promising growth prospects, and are all-around safer investments.

Via The Motley Fool · February 7, 2026

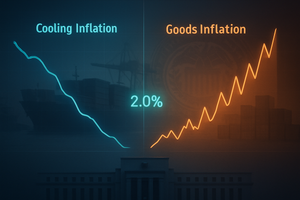

The latest Personal Consumption Expenditures (PCE) price index data has revealed a significant shift in the U.S. inflationary landscape, presenting a complex puzzle for the Federal Reserve. As of early February 2026, the data shows a stark divergence: while the services sector—the primary engine of post-pandemic inflation—is

Via MarketMinute · February 6, 2026

Via Benzinga · February 6, 2026

A number of stocks fell in the afternoon session after the "AI replacement" narrative reached a fever pitch following the release of new models from Anthropic and OpenAI.

Via StockStory · February 5, 2026

The powerhouse financial stock hasn't looked all that mighty lately.

Via The Motley Fool · February 5, 2026

Even with the longtime Berkshire Hathaway leader having stepped down as CEO, the Oracle of Omaha has a huge amount of wealth tied up in the stock.

Via The Motley Fool · February 5, 2026

American Express has underperformed the broader market over the past year, but analysts are cautiously optimistic about the stock’s prospects.

Via Barchart.com · February 5, 2026

The premium credit card entity just reported double-digit gains on the top and bottom lines in Q4.

Via The Motley Fool · February 4, 2026

The stock has averaged annual gains of nearly 14% over the past decade.

Via The Motley Fool · February 4, 2026

Credit cards have been in the news a lot lately.

Via The Motley Fool · February 3, 2026

A number of stocks fell in the afternoon session after fears of disruption from artificial intelligence spooked investors, leading to a broad-based sell-off.

Via StockStory · February 3, 2026

Volatility cuts both ways - while it creates opportunities, it also increases risk, making sharp declines just as likely as big gains.

This unpredictability can shake out even the most experienced investors.

Via StockStory · February 2, 2026