Dollar General (DG)

146.63

-2.11 (-1.42%)

NYSE · Last Trade: Jan 20th, 4:19 PM EST

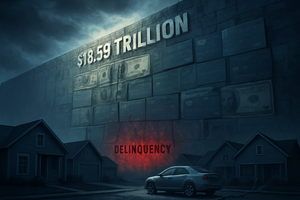

As of January 20, 2026, the American consumer is navigating a financial landscape defined by a staggering milestone: total household debt has officially surged past the $18 trillion mark, settling at a record $18.59 trillion. While the headline figure represents a massive expansion of credit, the underlying data reveals

Via MarketMinute · January 20, 2026

As the financial world braces for the upcoming 2026 fiscal year-end reports, the shadow of last year’s mid-cycle performance continues to loom large over the retail sector. On January 20, 2026, market analysts are still dissecting the "Great Retail Divergence" of early 2025—a pivotal moment when the two

Via MarketMinute · January 20, 2026

Low-volatility stocks may offer stability, but that often comes at the cost of slower growth and the upside potential of more dynamic companies.

Via StockStory · January 19, 2026

Realty Income, Vici, and Digital Realty should rise as interest rates decline.

Via The Motley Fool · January 19, 2026

These stocks sport dividend yields ranging from 2.9% to 5.5%.

Via The Motley Fool · January 19, 2026

The good news is that I don't think anyone has missed the bus.

Via The Motley Fool · January 18, 2026

This real estate investment trust rewards investors monthly.

Via The Motley Fool · January 17, 2026

Wall Street’s bearish price targets for the stocks in this article signal serious concerns.

Such forecasts are uncommon in an industry where maintaining cordial corporate relationships often trumps delivering the hard truth.

Via StockStory · January 15, 2026

The first full trading week of 2026 got off to a caffeinated start.

Via The Motley Fool · January 15, 2026

These companies are built for long-term success.

Via The Motley Fool · January 13, 2026

As the sun rises on January 13, 2026, the financial world is bracing for one of the most consequential economic data points of the new year. Tomorrow morning, the U.S. Census Bureau is scheduled to release the retail sales figures for December 2025—a report that serves as the

Via MarketMinute · January 13, 2026

As of January 12, 2026, the retail sector is witnessing a dramatic divergence in performance, with value-oriented giants leading the charge. Dollar General (NYSE: DG) has emerged as a primary beneficiary of this shift, with its stock price staging a remarkable recovery over the past year. After hitting multi-year lows

Via MarketMinute · January 12, 2026

Top S&P500 movers in Monday's sessionchartmill.com

Via Chartmill · January 12, 2026

What's going on in today's session: S&P500 moverschartmill.com

Via Chartmill · January 12, 2026

The decision about buying these dividend stocks is an easy one.

Via The Motley Fool · January 12, 2026

Another profitable year is in the books for investors. Whether you invested in 2025 or are looking to get started, this episode is for you!

Via The Motley Fool · January 11, 2026

Date: January 1, 2026 Introduction As we enter 2026, Dollar General Corporation (NYSE: DG) stands at a critical juncture in its eighty-year history. Once the undisputed "darling" of the retail sector, the company spent much of 2023 and 2024 navigating a perfect storm of operational missteps, rampant inventory "shrink," and regulatory scrutiny. However, the narrative [...]

Via PredictStreet · January 1, 2026

The S&P 500 climbed to a fresh all-time high on Wednesday, January 7, 2026, as investors cheered a combination of fiscal stimulus tailwinds and the accelerating commercialization of "Agentic AI." The benchmark index surged 1.2% during the session, briefly touching an intraday peak of 7,624.88 before

Via MarketMinute · January 7, 2026

These dividend stocks are in a league of their own.

Via The Motley Fool · January 7, 2026

Grocery retailer Albertsons (NYSE:ACI) will be reporting results this Wednesday before the bell. Here’s what to look for.

Via StockStory · January 5, 2026

As of December 26, 2025, the retail landscape has witnessed one of the most significant corporate transformations in recent memory: the rebirth of Dollar Tree, Inc. (NASDAQ: DLTR) as a streamlined, "pure-play" entity. After years of struggling to integrate its 2015 acquisition of Family Dollar, the company spent 2025 shedding its underperforming weight and leaning [...]

Via PredictStreet · December 26, 2025

Realty Income and Energy Transfer are reliable income plays in this wobbly market.

Via The Motley Fool · January 5, 2026

Dollar General (DG) momentum hits 89.60 ahead of the Jan 6 ex-dividend date. See why the stock is surging following a strong Q3 earnings beat.

Via Benzinga · January 5, 2026

Lower fees helped VDC outperform RSPS by over 2% in the last year, but equal weighting offers better diversification.

Via The Motley Fool · January 4, 2026

As the confetti settles from New Year’s celebrations, investors are quickly pivoting from the "Santa Claus Rally" of 2025 to a sobering reality: the first major economic hurdle of the year. On Friday, January 2, 2026, the market opened its first session of the year with a mix of

Via MarketMinute · January 2, 2026