Stellantis N.V. Common Shares (STLA)

7.5250

+0.2150 (2.94%)

NYSE · Last Trade: Feb 10th, 3:01 PM EST

Stellantis Eyes Exiting Battery JV With Samsung Amid EV Pullback: Reportstocktwits.com

Via Stocktwits · February 10, 2026

The Dow Jones Industrial Average (DJIA) achieved a monumental milestone on Friday, February 6, 2026, closing above the 50,000 mark for the first time in history. The index finished the week at 50,115.67, gaining over 1,200 points in a single session to cap off a historic

Via MarketMinute · February 9, 2026

Dow 50,000: A Milestone for the History Books Amidst an AI Spending Warchartmill.com

Via Chartmill · February 9, 2026

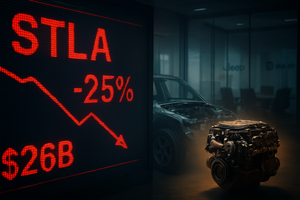

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

Investors were surprised by the cost of Stellantis's EV reset, and not in a good way.

Via The Motley Fool · February 6, 2026

These stocks are the most active in today's sessionchartmill.com

Via Chartmill · February 6, 2026

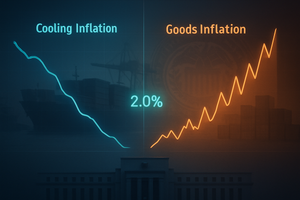

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

The latest Personal Consumption Expenditures (PCE) price index data has revealed a significant shift in the U.S. inflationary landscape, presenting a complex puzzle for the Federal Reserve. As of early February 2026, the data shows a stark divergence: while the services sector—the primary engine of post-pandemic inflation—is

Via MarketMinute · February 6, 2026

Get insights into the top gainers and losers of Friday's pre-market session.chartmill.com

Via Chartmill · February 6, 2026

The charges stem from a reset of Stellantis’ EV strategy after the company said it overestimated the pace of electric vehicle adoption.

Via Stocktwits · February 6, 2026

The semiconductor giant plays a central role in the expansion of the AI market.

Via The Motley Fool · February 4, 2026

The announcement, delivered from the East Room alongside the CEOs of the nation's largest industrial titans, marks a fundamental shift in U.S. economic policy. By treating critical minerals with the same strategic gravity as crude oil, the administration intends to provide a "sovereign shock absorber" for domestic manufacturers. For

Via MarketMinute · February 2, 2026

According to a Bloomberg report, the initiative will create a centralized reserve of essential metals and minerals, including rare earths, to help shield companies from volatile global markets influenced by China.

Via Stocktwits · February 2, 2026

The electric vertical takeoff and landing (eVTOL) market offers huge upside potential, but also downside risk.

Via The Motley Fool · January 31, 2026

As the final trading day of January 2026 draws to a close, North American markets are grappling with a renewed surge in trade-related volatility. On January 30, 2026, shares of Bombardier Inc. (TSX: BBD.B) plunged by over 7% following a direct broadside from the White House, marking a sharp

Via MarketMinute · January 30, 2026

Former hedge fund manager Jim Cramer says shares of Amazon and Uber can go even higher.

Via The Motley Fool · January 29, 2026

Apple is a better long-term play than this speculative voice AI stock.

Via The Motley Fool · January 28, 2026

DETROIT — January 28, 2026 — General Motors (NYSE: GM) has once again defied industry skeptics, reporting a resilient fourth-quarter performance that underscores its transition from a volume-focused automaker to a lean, earnings-per-share powerhouse. On the heels of a fiscal year defined by record-breaking internal combustion engine (ICE) sales and a disciplined

Via MarketMinute · January 28, 2026

In a pivotal moment for the American automotive landscape, General Motors (NYSE: GM) released its fourth-quarter and full-year 2025 earnings on January 27, 2026, unveiling what analysts are calling "The Great Recalibration." The Detroit giant delivered a staggering beat on adjusted earnings per share, reporting $2.51 against Wall Street

Via MarketMinute · January 27, 2026

The era of uncontested dominance for Tesla, Inc. (NASDAQ: TSLA) in the European Union appears to have hit a significant roadblock. On Tuesday, January 27, 2026, shares of the Austin-based automaker plummeted by 8%, following a series of data releases from the European Automobile Manufacturers' Association (ACEA) that confirmed a

Via MarketMinute · January 27, 2026

Date: January 27, 2026 Introduction In the volatile landscape of the global automotive industry, few stories are as compelling as the recent resurgence of General Motors (NYSE: GM). Once a symbol of industrial struggle following the 2008 financial crisis, GM has transformed itself into a lean, profit-generating powerhouse that is effectively bridging the gap between [...]

Via Finterra · January 27, 2026

Apple offers a relatively low-risk, potentially high-reward investment proposition.

Via The Motley Fool · January 27, 2026

Via MarketBeat · January 26, 2026

In a landmark move for the future of motorsport, Google Cloud (Alphabet - NASDAQ: GOOGL) and the ABB (NYSE: ABB) FIA Formula E World Championship have officially entered a new phase of their partnership, elevating the tech giant to the status of Principal Artificial Intelligence Partner. As of January 26, 2026, the collaboration has moved [...]

Via TokenRing AI · January 26, 2026